IR35 Status Assessment Tool

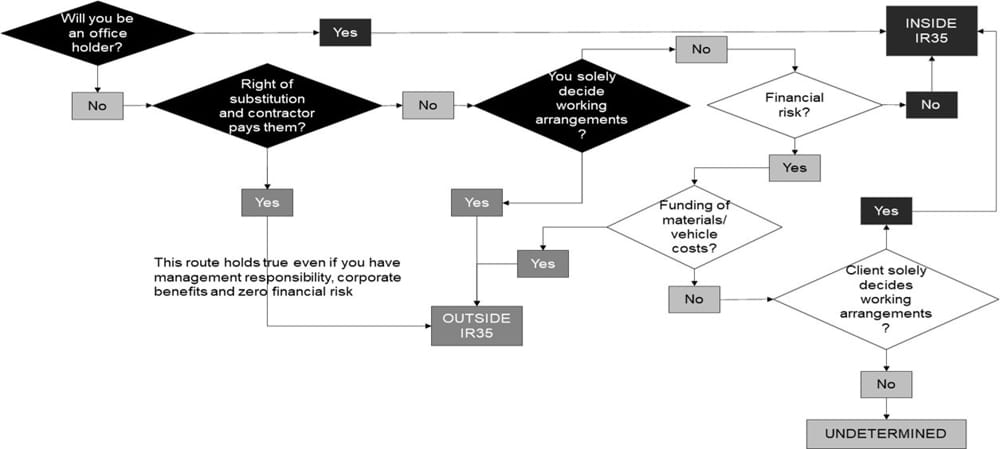

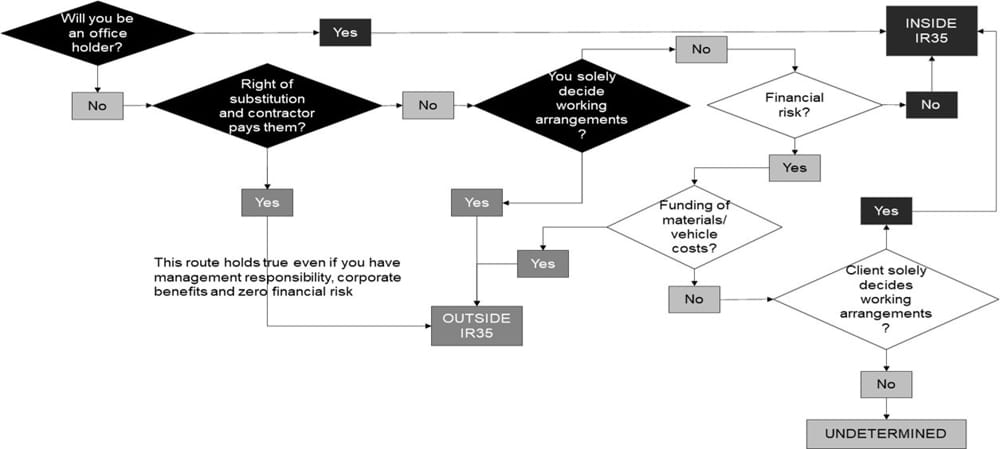

Through our research, we spent scores of hours boiling down HMRC’s Check Employment Status for Tax (CEST) assessment tool into a simple one-page process flow

- The 34square assessment tool is aligned with CEST where it needs to be.

- Unlike CEST it always gives you an outcome. In fact CEST renders an undetermined outcome for a great many combinations of responses.

- 34square more specifically addresses mutuality of obligation.

- We raise the bar to more realistic levels of financial risk in order to justify being in business on one’s own account.

- We uniquely incorporate the option to embrace the powerful 34square Right of Substitution Declaration and give your substitution clause teeth.

- A maximum of 25 questions, including the final declaration question, all with their role to play in robustly establishing the IR35 status conclusion. Questions rendered irrelevant by earlier responses are skipped.

Inside IR35 or Outside?

After more than 20 years, the notion that IR35 status determination is a mystical art, with an infinite list of variables and combinations that warrant artificial intelligence in order to fathom, is still at large and widely accepted. In reality, it's not a large or complex data set. Our assessment questionnaire helps you understand that data set and the IR35 status drivers, even to the extent it shares the engagement attributes and working practices you should explore in order to reach an accurate, fair and equitable outcome. Parties are well within their rights to derive or refine those attributes and practices for a particular status outcome, as long as they reasonably reflect genuine intent and subsequent reality. No engagement is by definition, inside or outside. It's about how the client chooses to buy the services and engage the worker.

- If the inferred contract between a contractor and an end client can be proven to be FOR services provided by their limited company, as opposed to a contract OF service performed by the contractor, this can be a sole determinant of outside IR35.

- Let’s assume a contractor is forced beyond resolution to be unable to deliver the services to their company’s client at a critical time, such as a project go live week.

- If the client forbids a substitute, they endanger the contractor’s ability to continue to meet their company’s contractual obligations to the end client.

- If the client sources a substitute other than via the contractor’s limited company, that company has then lost control of the delivery entirely.

- The firm inference is that the contract is with the individual and NOT their limited company. If the contractor is not available in person, the client wants another resource from elsewhere, which firmly indicates the presence of personal service.

- Conversely, if the contractor’s company is permitted to provide a substitute, their company retains service delivery control, with the firm inference that the contract is indeed one FOR SERVICES delivered by their limited company, NOT personal service.

The 34square Difference

- HMRC targets weaknesses in right of substitution in any dispute.

- In 36 appeals cases reviewed by 34square, the 17 contractors that lost their appeals, ALL had weaknesses in their rights of substitution.

- One fundamental challenge is how to prove capability and intent to utilise a substitution process, when substitutions have not already occurred. The reality is substitution is hardly ever used.

- It should be noted HMRC cannot force a contractor to take time off, nor can they force a client to deploy any cover for if and when they do. This is why HMRC CANNOT conclude that having executed a substitution already, is a firmer demonstration of the legal right than only an intent to do so.

- What 34square services and capabilities provide is irrefutable evidence of both the existence of the legal right between contractor and end client and the technical and legal capability to feasibly carry it out. We can also evidence that the substitution could and would be carried out to the letter of HMRC stipulations, including the contractor company engaging and paying the substitute.