IR35: GRASP THE BENDY POLE...

Is outside IR35 for the high jump? Well, agents and clients that embrace it will recruit the best talent, faster. Agents that can work with clients to consistently and predictably embrace outside IR35, will be more competitive; win more business. Surely competitive advantage will defeat complacency?

Many clients believe they aren’t paying more with inside IR35 or other PAYE routes. In many cases you aren’t. That’s the point. You’re paying possibly 15-25% LESS, but it’s costing YOU the same. Your money is working nowhere near as hard. And when you are paying for talent and effort, you often get what you pay for. Put another way, if your money isn't working hard...

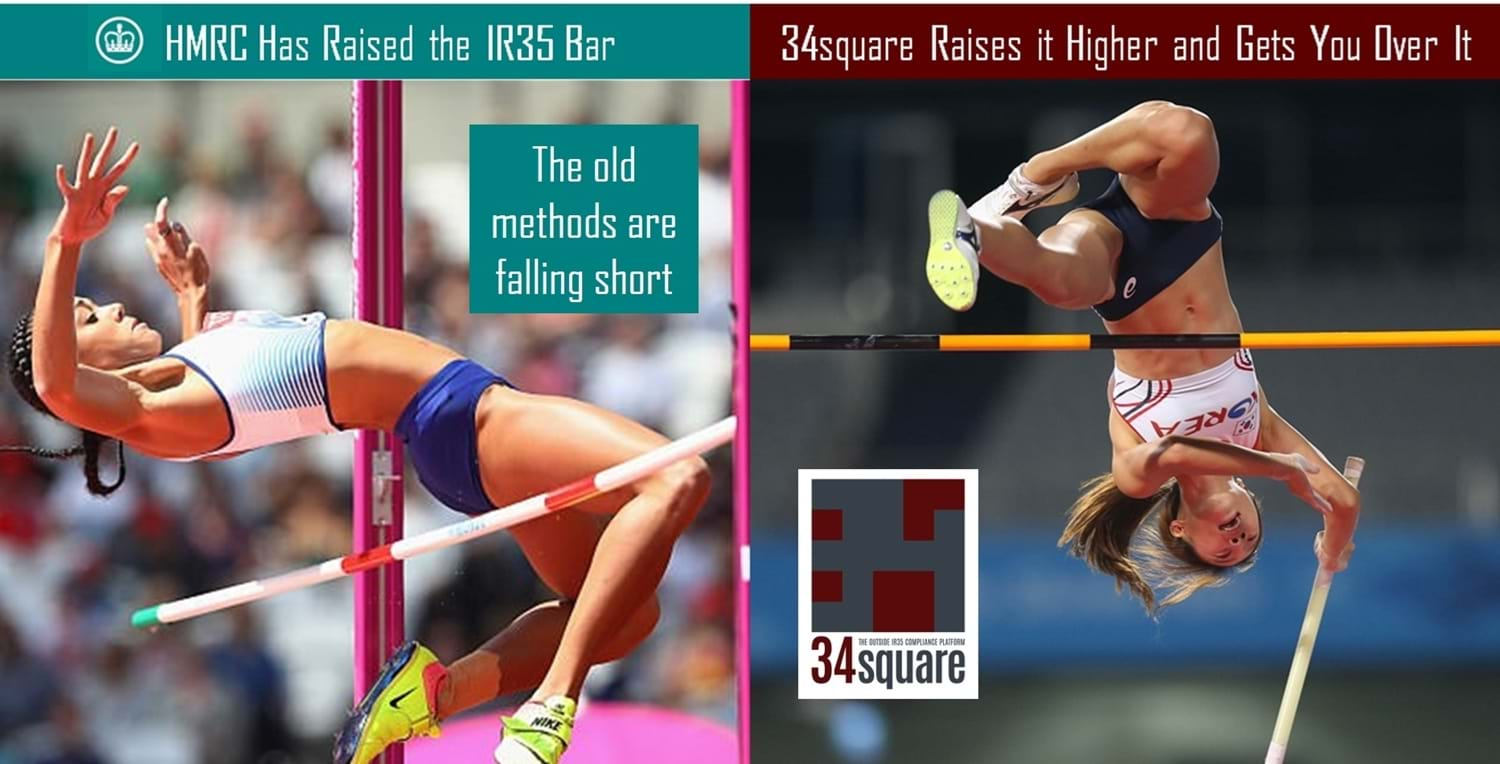

The determining factors of employment status haven’t changed. Surely the bar to qualify for outside IR35 is at exactly the same height? Indeed that may be true. However, making medium and large private enterprises responsible and liable for IR35 status determinations, has moved the decision to a party with a substantially lower appetite for risk. A party that often harbours a potentially naïve and overly optimistic perception that forcing contractors down a PAYE route won’t make any difference to them. See paragraph 2. So, the bar might be the same height, but it looks a lot higher to the inexperienced jumper that believes they don’t really need to bother clearing it.

There are plenty of assessment tools and service providers. Some clients are looking for insurance against the risks with an outside IR35 engagement. So, if an assessment is borderline, that outside IR35 bar will probably be clattered from its perch. As a result, many engagements that COULD be harnessing the inescapable additional client, agent and contractor value of outside IR35. are NOT.

Hundreds, perhaps thousands of IR35 experts know exactly how to structure an engagement for outside IR35, such that it should sail through an assessment. The problem is, whilst some of those experts and assessment service providers may choose to advise on engagement working practices and contractual terms, they cannot truly elevate the credentials of an engagement or capabilities of the parties, to get the engagement over that bar.

34square doesn’t just assess your engagement. We empower it. Consistently and predictably. We DO elevate your credentials and capabilities. Then we incorporate them into your qualifying criteria for outside IR35. And you sign up to them. We have set that outside IR35 bar higher than HMRC’s. We facilitate a legal right of substitution and feasible capability that exceeds HMRC minimum expectations and solely determinant examples in case law precedent. Funded entirely by nominal contractor annual subscriptions, with no charges for agents or clients, we enable subscribed contractors and registered agents and clients, to soar over the HMRC bar with:

- An innovative, ever-present contractor substitution capability, complete with generated legally binding contracts. Take a look here. Many clients may see this as a 'fright' of substitution, perhaps due to a misguided expectation that they will encounter strangers in place of their chosen resources and have no power to intervene. In reality, it’s a benefit for them, providing an assurance that contractual obligations can still be met, even if the main resource is unavoidably unavailable at a critical time. 34square enables contractor limited companies to punch above their weight should they need to, essentially being part of a much larger virtual consulting company. If they abuse it and/or compromise delivery, terminate the contract. Just as you would for any other shortcoming.

- A Right of Substitution Declaration between worker and client, that removes any ambiguity over the right and its conditions. Our Right of Substitution Declaration FAQs explain what clients are, and most importantly are NOT signing up to.

- A Status Determination Statement (SDS) via our platform that incorporates a robust set of outside IR35 determining factors and goes further than the reasonable care measures described in HMRC’s Employment Status Manual. It’s fully workflow-driven, with audit trail, document emailed to all parties, automatic secure storage and retrieval on our platform and even a reminder to review and re-issue periodically. We also provide the mandated SDS disputes service, not that you’re likely to need it.

So, why charge towards that menacingly lofty HMRC high jump bar with just your own steam? Grasp the bendy pole that is 34square and you will hardly be able to see the bar, several metres below your flight path.